Sarbanes-Oxley Act usually the abbreviation SOX is used. O All of the other answers represent management responsibilities under the Sarbanes-Oxley Act.

Chapter 1 Auditing Assurance And Internal Control Hall

Chapter 1 Auditing Assurance And Internal Control Hall

So it is the.

Under the sarbanes oxley act management is responsible for. Analysts having positive comments about the companys operations. The Sarbanes-Oxley Act of 2002 SOX passed by Congress and enforced by the Security Exchange Commission SEC is designed to protect shareholders and the general public from accounting errors and fraudulent practices used by businesses and to improve the accuracy of corporate disclosures. Lawmakers believe that most cases of fraud and accounting dishonesty stem from corrupt corporate leaders.

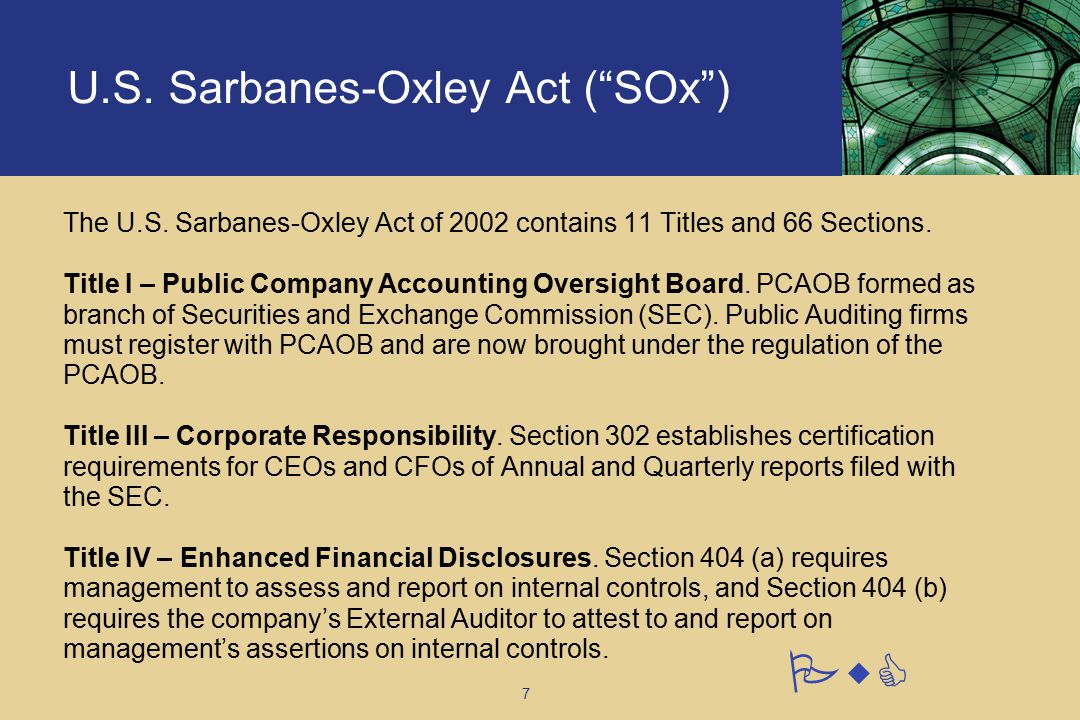

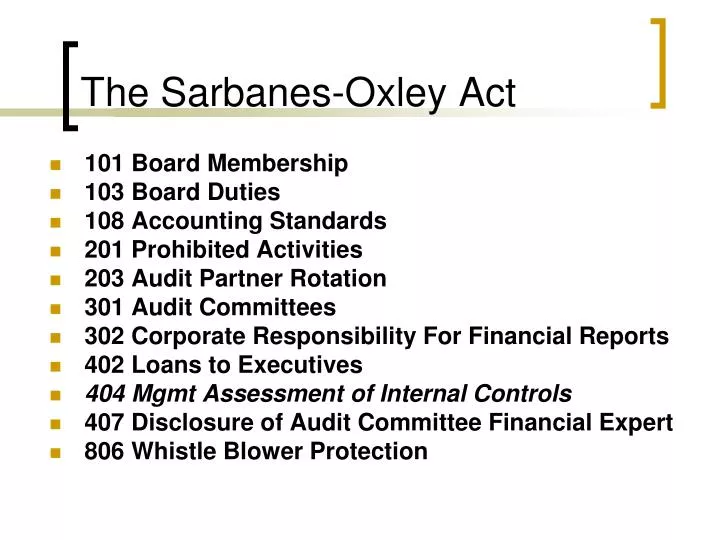

This act was enacted to safeguard investors from corporate fraud which are fraudulent accounting activities by corporations. THE ACT ESTABLISHES THE PUBLIC COMPANY Accounting Oversight Board PCAOB to regulate accounting professionals that audit the financial statements of public companies. Increasing the companys stock price.

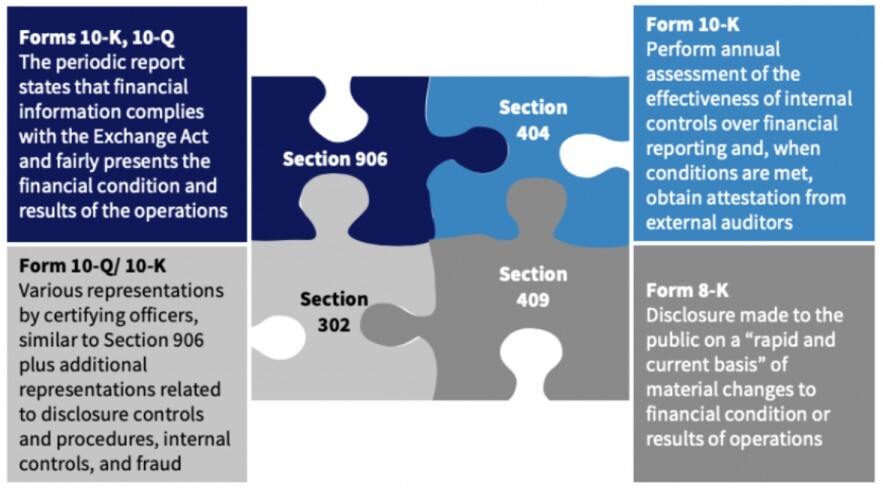

Under the Sarbanes-Oxley Act management is responsible for. The act requires that top managers personally certify the accuracy of financial reports. The essence of Section 302 of the Sarbanes-Oxley Act states that the CEO and CFO are directly reponsible for the accuracy documentation and submission of all financial reports as well as the internal control structure to the SEC.

The audit committee of the companys board of directors 114. According to the Sarbanes-Oxley Act of 2002 who is primarily responsible for establishing and maintaining a system of internal control over the companys financial reporting. The Sarbanes-Oxley Act of 2002 mandates that audit committees be directly responsible for the oversight of the engagement of the companys independent auditor and the Securities and Exchange Commission the Commission rules are designed to ensure that auditors are independent of.

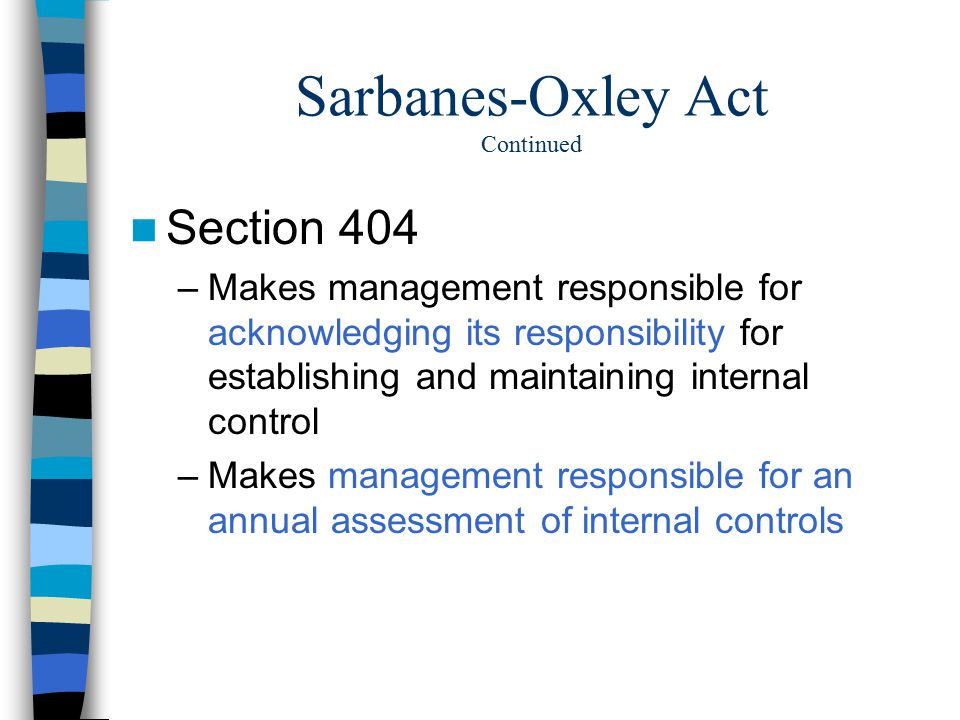

The Sarbanes-Oxley Act SOX Act was passed by the congress of the United States on July 30 2002 this act is also called the Corporate Responsibility Act of 2002. And 2 contain an assessment as of the end of the most recent fiscal year of the issuer of the effectiveness of the internal control structure and procedures of the issuer for financial reporting. 1 state the responsibility of management for establishing and maintaining an adequate internal control structure and procedures for financial reporting.

Under the Sarbanes-Oxley Act of 2002 corporate officers and directors are personally responsible for the reliability of their companys financial statements. Lawmakers believe that most cases of fraud and accounting dishonesty stem from corrupt corporate leaders. THE SARBANES-OXLEY ACT OF 2002 is a major reform package mandating the most far-reaching changes Congress has imposed on the business world since FDRs New Deal.

Management AssertionsUnder the Sarbanes-Oxley Act of 2002 corporate officers and directors are personally responsible for the reliability of their companys financial statements. Sarbanes-Oxley Act creates a meticulous code of conduct for the purpose of accounting controls commercial or business enactments and ethical revelation of financial reports. - registration of accounting firms that audit public companies in the US.

The Sarbanes-Oxley Act changed managements responsibility for financial reporting significantly. 3 It became law on July 30 2002. The companys auditors C.

- establishment of auditing quality control and ethics standards for registered accounting firms. SOX also known as Public Company Accounting Reform and Investor Protection Act in US Senate aims to protect stakeholders of securities markets shareholders of corporations buyers and. The Act is named after its sponsors Senator Paul Sarbanes D-Md and Congressman Michael Oxley R-Ohio.

Its also called Sarbox or SOX. It holds CEOs personally responsible for errors in accounting audits. Sarbanes-Oxley Act SOX Definition.

Oxley which sets duties and responsibilities of business managers and corporate lawyers accountants and auditors. Multiple Choice The reliability of financial statements. Corporate Responsibility for Financial Reports.

Management of the company B. The Sarbanes-Oxley Act or SOX is one such key regulation governing the financial accounting practices policies of public enterprises that are based andor operating in the United States. The Sarbanes Oxley Act gives to the PCAOB four primary responsibilities.

It is an American law named after the proposers Paul Sarbanes and Michael G. The companys internal auditors D. Here is the direct excerpt from the Sarbanes-Oxley Act.

- inspections of registered accounting firms.

Solved Under The Sarbanes Oxley Act The Ceo And Cfo Cert Chegg Com

Solved Under The Sarbanes Oxley Act The Ceo And Cfo Cert Chegg Com

What Is Sox Compliance Everything You Need To Know In 2019

What Is Sox Compliance Everything You Need To Know In 2019

Solved Under The Sarbanes Oxley Act Management Is Respon Chegg Com

Solved Under The Sarbanes Oxley Act Management Is Respon Chegg Com

What Is Sox Compliance Requirements Controls Dnsstuff

What Is Sox Compliance Requirements Controls Dnsstuff

Shelley Tremblay And Peter Laureshen Ppt Download

Shelley Tremblay And Peter Laureshen Ppt Download

Iosco Seminar Transition To Ifrss Challenges For Supervisors Ppt Download

Iosco Seminar Transition To Ifrss Challenges For Supervisors Ppt Download

What Is Sox Compliance Everything You Need To Know In 2019

What Is Sox Compliance Everything You Need To Know In 2019

Sox For Everyone Brief History Of Internal Control Sox And Fundamentals Of Control Frameworks Source Brink S Modern Internal Auditing Robert Moeller Ppt Video Online Download

Sox For Everyone Brief History Of Internal Control Sox And Fundamentals Of Control Frameworks Source Brink S Modern Internal Auditing Robert Moeller Ppt Video Online Download

Chapter 1 Auditing And Assurance Services Presentation Outline

Chapter 1 Auditing And Assurance Services Presentation Outline

Chapter 15a It Controls Part I Sarbanes Oxley It Governance Ppt Download

Chapter 15a It Controls Part I Sarbanes Oxley It Governance Ppt Download

Ppt The Sarbanes Oxley Act Powerpoint Presentation Free Download Id 3997465

Ppt The Sarbanes Oxley Act Powerpoint Presentation Free Download Id 3997465

Sarbanes Oxley Sox Compliance Gitlab

Sarbanes Oxley Sox Compliance Gitlab

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.