In both cases they use their own equipment for such work. This will open the Review and edit your account info page where you can update your User ID password name email security questionanswer billingshipping info and payment information.

Should You Do Your Taxes On Your Cell Phone

Should You Do Your Taxes On Your Cell Phone

Make a payment or wait for your refund.

Can i do my taxes on my phone. Often people use their mobile phone during work or after work hours to contact staff management. All you need to do is provide some personal information and answer a series of short questions over the phone. There are no paper forms to fill out or calculations to do.

However you must genuinely use your mobile phone for work purpose to be eligible to claim a tax deduction. If 30 percent of your time on the phone is spent on business you could legitimately deduct 30 percent of your phone bill. If your employer requires you to pay for office supplies or certain phone expenses you may be able to claim those expenses.

Pay taxes you owed options if you cannot pay or arrange to pay over time. Can I claim my mobile phone as tax deduction. Ad Search For Relevant Info Results.

In Entrepreneur magazine writer Kristin Edelhauser recommends getting an itemized. Get Results from 6 Engines. With this interactive and engaging app you can quickly and easily enter information using visual icons and sliders to see where you stand before you file.

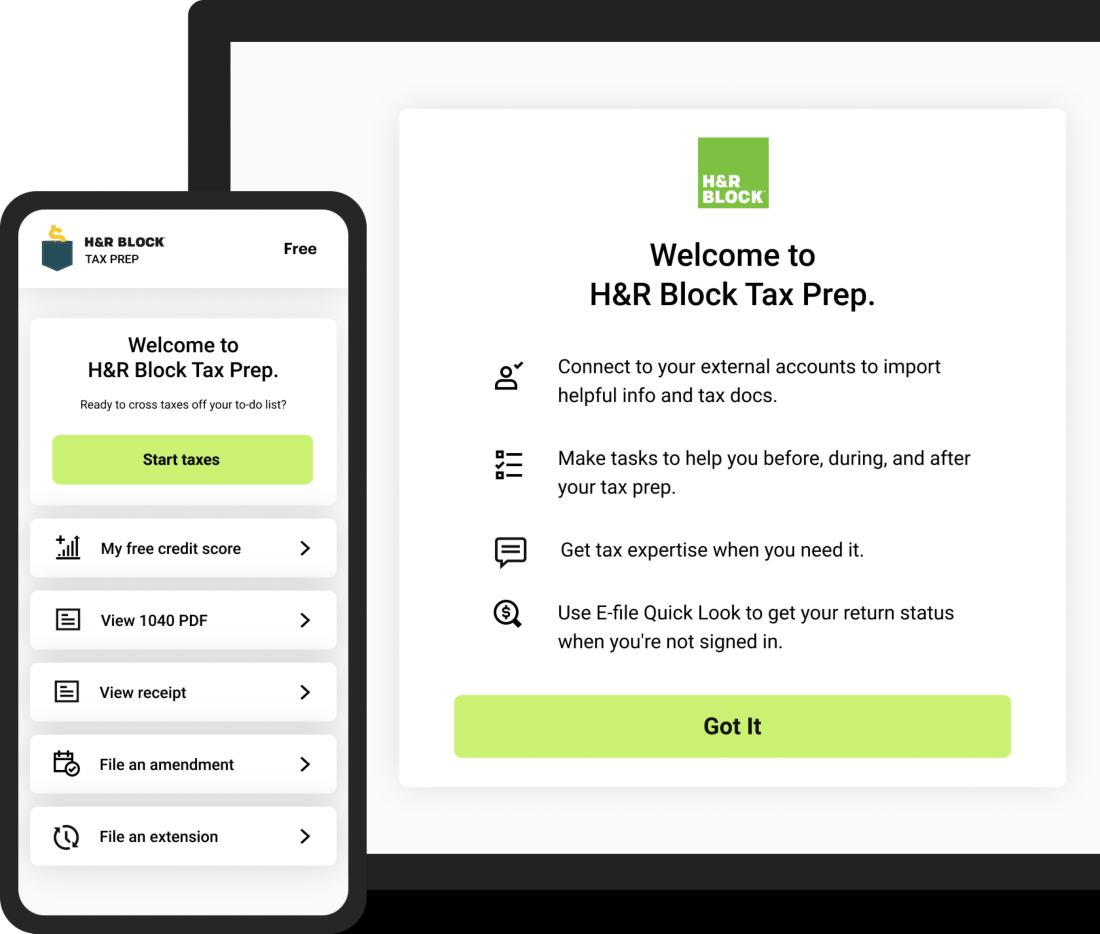

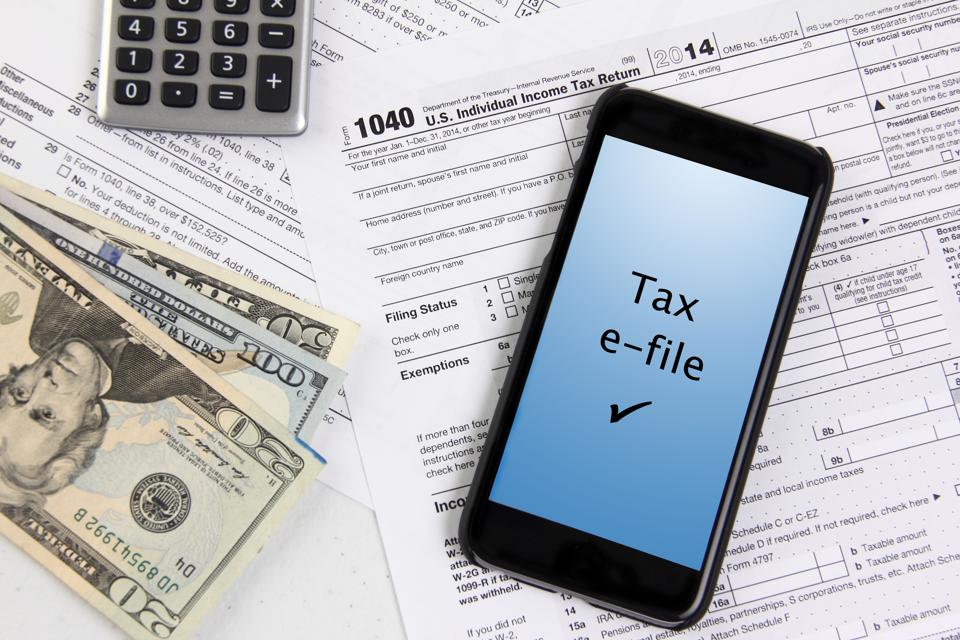

From start to finish you can use your smartphone tablet or computer to complete your 2016 tax return using HR Blocks Online tax software. Now available for iPad as well as iPhone and Android devices TaxCaster is a free and easy way to estimate your tax refund. The answer is YES.

Get Results from 6 Engines. You will get a refund if you paid more taxes than needed. Although you can claim these expenses they are not related to the physical work space in your home.

Your computer cell phone Internet service software and even some cool tech gadgetry are possible tax deductions if you must use them to run your business. Offer may change or end at any time without notice. Get free customer support with real people 7 days a week all based in the United States.

If you purchased a phone outright that you use partly for work you can claim a percentage of the purchase price. Instructions for Form 1040 Form W-9. After you file your tax return.

File your tax return online or mail us your completed tax return. TurboTax online and mobile pricing is based on your tax situation and varies by product. Office supplies and phone expenses.

You may deduct certain business telephone expenses regardless of. The major software products like Turbo Tax HR Block and TaxAct let you prepare the short forms 1040A and 1040EZ as well as the 1040 long. That means you can register for a new account using your smartphone sign in and enter your personal information using your tablet and complete and file your return on your personal computer.

Request for Taxpayer Identification Number TIN and Certification Form 4506-T. If you want to change the phone number on your Tax Return you can go to the Personal Info tab and change your number there in the address. Ad Search For Relevant Info Results.

They are claimed on a different section of Form T777S or Form T777. The invitation letter will guide you through the. This service is for eligible individuals with a low or fixed income.

File my Return lets eligible Canadians with low or fixed income whose tax situations remain unchanged from year-to-year file their income tax and benefit return through a dedicated automated phone service. You can qualify for a cell phone tax deduction from cell phone charges incurred when the mobile phone is being used exclusively for business. The IRS is generally friendly toward the deduction of business expenses from your taxable income and phone use is no exception.

Request for Transcript of Tax. Michael Carney owner and president of MWC Accounting in Chicago said expensive tech hardware can qualify if it is an asset that retains its value over several years. Individual Tax Return Form 1040 Instructions.

TurboTax Free Edition 0 Federal 0 State 0 To File is available for simple tax returns only. If the phone was below 300 you can claim the business percentage of that amount as a one-off tax deduction. Automated phone line File my Return Send us your completed tax return.

Can I include the cost of buying my phone in my phone expenses. However you can also deduct. There are no paper forms to fill out or calculations to do.

There is not an IRS cell phone deduction for self employed people exclusively. If youre self-employed and you use your cellphone for business you can claim the business use of your phone as a tax deduction. Try for FreePay When You File.

If you are eligible you will receive a letter inviting you to use the automated phone service to. The File my Return service is free secure and easy to use. Have a balance owing.

Using File my Return is free secure and easy to use.

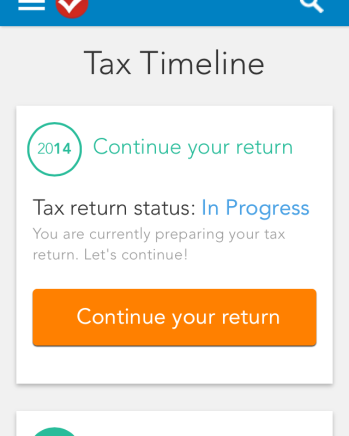

Turbotax File Tax Return Max Refund Guaranteed Apps On Google Play

I Did My Taxes On My Phone This Year Turbotax Mobile Site Ftw Ux Rocks

I Did My Taxes On My Phone This Year Turbotax Mobile Site Ftw Ux Rocks

How To Contact The Irs If You Haven T Received Your Refund

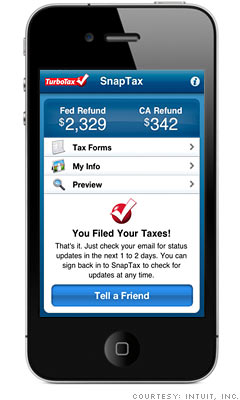

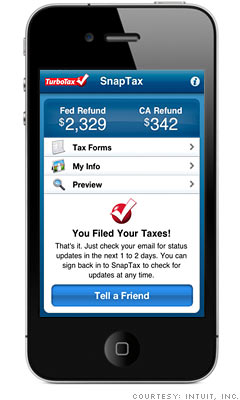

7 Best Apps For Filing Taxes File Your Taxes By Phone 2 Cnnmoney Com

7 Best Apps For Filing Taxes File Your Taxes By Phone 2 Cnnmoney Com

Turbotax Mobile App Do Your Taxes On Your Phone Tablet Or Computer

Turbotax Mobile App Do Your Taxes On Your Phone Tablet Or Computer

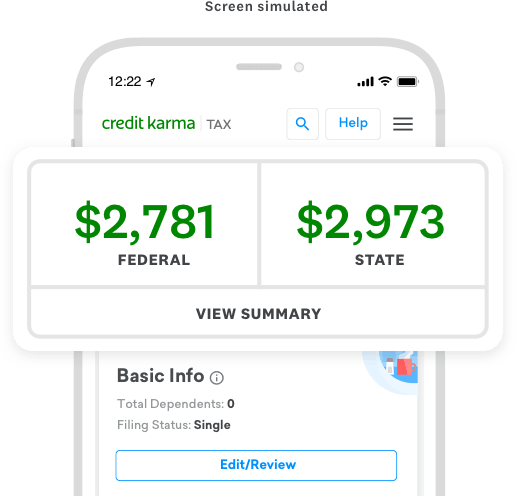

Free Tax Filing Online 0 State Federal Credit Karma Tax

Free Tax Filing Online 0 State Federal Credit Karma Tax

Turbotax Mobile App Do Your Taxes On Your Phone Tablet Or Computer

Turbotax Mobile App Do Your Taxes On Your Phone Tablet Or Computer

Turbotax Mobile App Do Your Taxes On Your Phone Tablet Or Computer

Turbotax Mobile App Do Your Taxes On Your Phone Tablet Or Computer

Free File Is Now Open For Taxpayers

Free File Is Now Open For Taxpayers

4 Free Ways To Do Your Taxes On Your Phone

4 Free Ways To Do Your Taxes On Your Phone

Should I Do My Own Taxes How To Know When You Need A Pro Rasmussen University

Should I Do My Own Taxes How To Know When You Need A Pro Rasmussen University

Filing Taxes On Your Phone Insert Frustrated Face Emoji Here The New York Times

Filing Taxes On Your Phone Insert Frustrated Face Emoji Here The New York Times

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.