But Chapter 11 is a two way street with creditors. Because the debt involved tends to be high creditors are extremely concerned about getting a good portion of their money back.

Difference Between Chapter 7 Chapter 11 And Chapter 13 Bankruptcy

Difference Between Chapter 7 Chapter 11 And Chapter 13 Bankruptcy

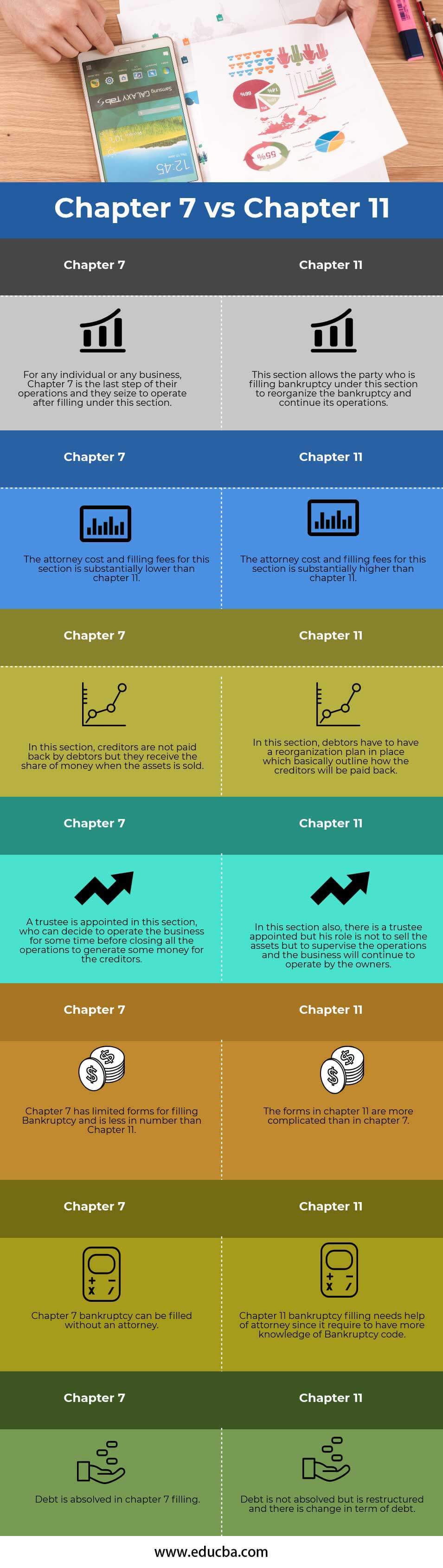

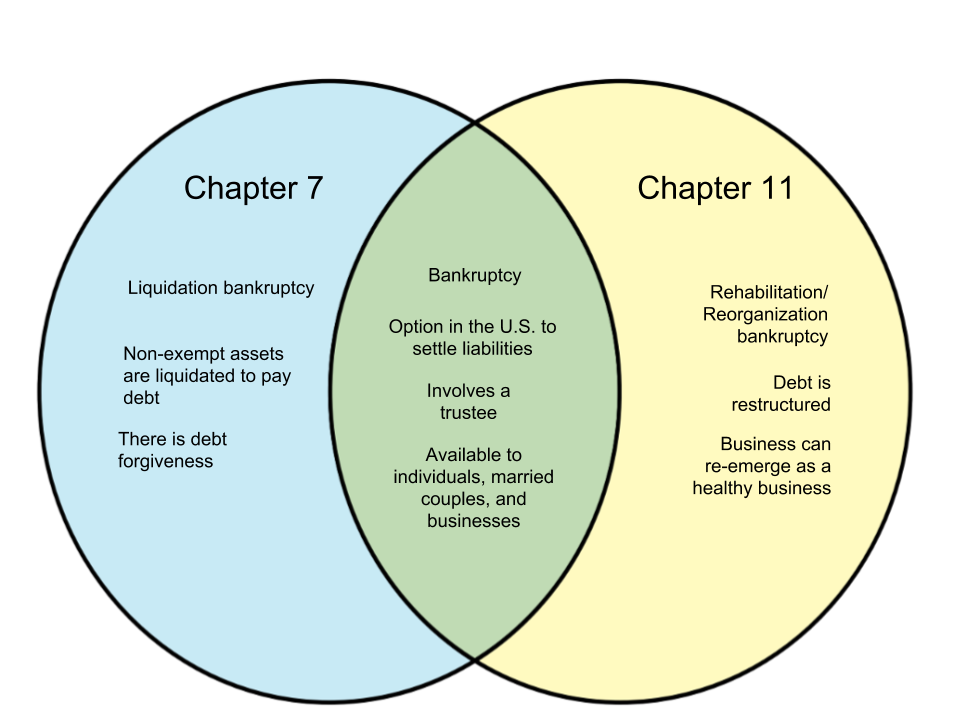

The main difference between Chapter 7 bankruptcy and Chapter 11 bankruptcy is that debts are not discharged.

/what-is-chapter-7-bankruptcy-316202color-355f125a28264491a0cac1313e2c914b.jpg)

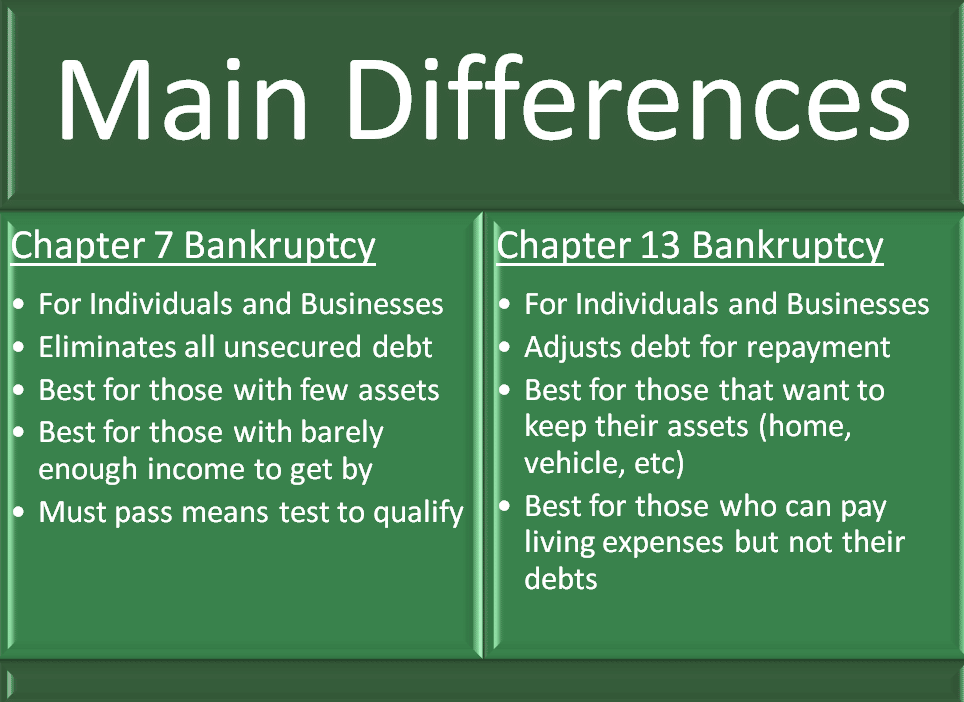

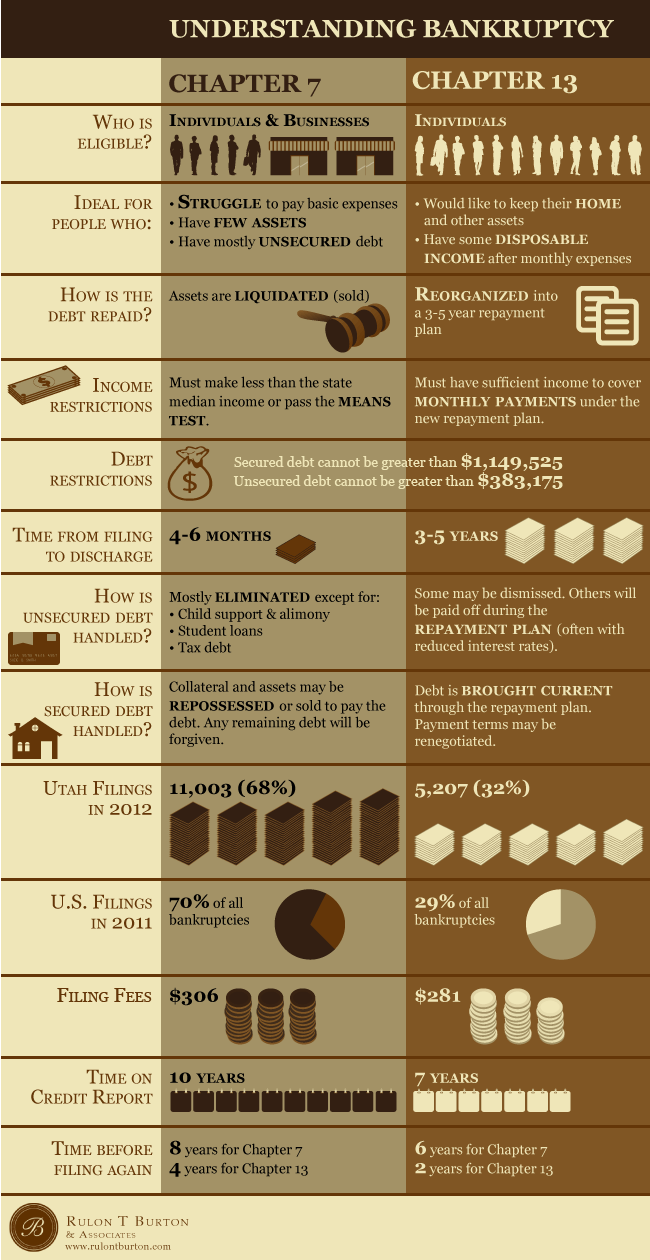

Difference between chapter 7 and chapter 11. If you have considered filing for bankruptcy you will need to decide which type of bankruptcy to file. 1 StraightLiquidation Chapter 7 only. Assess Chapter 7Chapter 11Chapter 13 bankruptcy options In addition to Chapters 7 and 11 you may want to look at Chapter 13 bankruptcy.

So if you file for Chapter 7 youll have to sell your assets to pay as many creditors as possible. You do not lose everything if you file for bankruptcy either Chapter 7 or Chapter. Instead repayments are re-organized.

People who file Chapter 7. If that proves not to be possible the business can then file for Chapter 7 and liquidate assets. What is the Difference.

Each class of creditors can be provided for in the bankruptcy plan proposed by the Chapter 11 debtor in possession often in the form of monthly payments distributed based on the types of debt the filer has. In exchange Chapter 7 debtors give up property but they get to keep some. Chapter 7 debtors dont have any money left over after paying for their ongoing living expenses so they dont have money to make a payment in Chapter 13.

Chapter 11 is the chapter used by large businesses to reorganize their debts and continue operating. Creditors will be willing to negotiate with debtors because they know that if theyre too aggressive they might force a debtor into Chapter 7 liquidation and receive little or nothing at the end of the day. Chapter 7 and Chapter 13.

In both a Chapter 7 and Chapter 11 filing by a corporation its likely that the common shareholders would. Chapter 11 is more for business. Chapter 11 stays on your credit for seven years from filing so this can hinder your financial goals for a long time.

Both paths provide comprehensive debt relief. The Chapter 11 is a reorganization bankruptcy for the business. After the debtors files a Chapter 11 case theyll disclose their income assets and debts on official bankruptcy forms and begin negotiating their reorganization plans with their creditors.

Humans as opposed to corporate entities have three. 2 Reorganization Chapters 9 11 12 and 13. If a business is filing Chapter 11 its expected to continue operating successfully.

When an individuals income is too high and debts exceed Chapter 13 limits he must file a Chapter 11 in order to receive bankruptcy relief. It is for people who can not afford to pay back their debts. Chapter 11 and Chapter 13 Bankruptcy Chapter 11 and Chapter 13 filings are similar.

Filing for Chapter 7 means the debtor cannot file for this type of bankruptcy for another seven years. Chapter 7 is for a person company or corporation and will discharge the filing debtor in exchange for giving up assets. Chapter 7 Bankruptcy In a Chapter 7 bankruptcy the assets of the filing party are liquidated in order to pay the creditors and the remaining qualified debt is.

Chapter 13 is for individuals as is Chapter 11 though the latter was originally designed for corporations. A Chapter 7 bankruptcy will. Chapter 7 of bankruptcy code is responsible for controlling the process of the liquidation of the assets where absolute priority rule are mentioned that stipulates the order according to which payment of the debt will be made whereas in case of Chapter 11 of bankruptcy code individual or the business that requires some time duration for debt repayment will approach the creditors for changing the terms and condition for the.

Chapter 7 is more common and what most people file. The biggest difference between Chapter 11 and Chapter 7 is that Chapter 11 is a reorganization bankruptcy while Chapter 7 is a liquidation bankruptcy. The difference between Chapter 7 vs.

A Chapter 7 will in effect put a business out of business while a Chapter 11 may make lenders wary of dealing with the company after it emerges from bankruptcy. There are two main paths to bankruptcy debt relief for individuals and their families. The main difference between Chapter 7 and Chapter 11 bankruptcy is that under a Chapter 7 bankruptcy filing the debtors assets are sold off to pay the lenders creditors whereas in Chapter 11 the debtor negotiates with creditors to alter the terms of the loan without having to liquidate sell off assets.

What they get to keep is property that is protected by state or federal law or using legal language. Creditors can disapprove of a re-organization plan and in some cases can actually convert the Chapter 11 to a Chapter. Chapter 11 for a business is that Chapter 11 allows a business to continue operating.

Corporations partnerships and limited liability companies cannot use chapter 13 to reorganize and must cease business operations if a chapter 7 bankruptcy is filed.

Chapter 7 Vs Chapter 11 Top 7 Differences To Learn With Infographics

Chapter 7 Vs Chapter 11 Top 7 Differences To Learn With Infographics

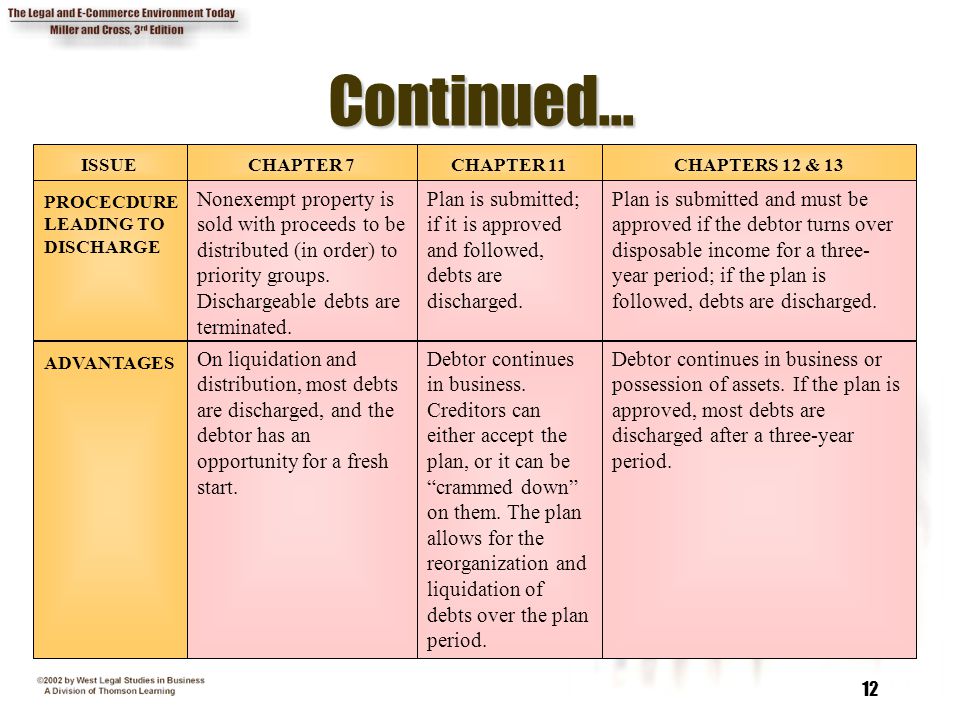

Chapter 15 Creditors Rights And Bankruptcy Ppt Video Online Download

Chapter 15 Creditors Rights And Bankruptcy Ppt Video Online Download

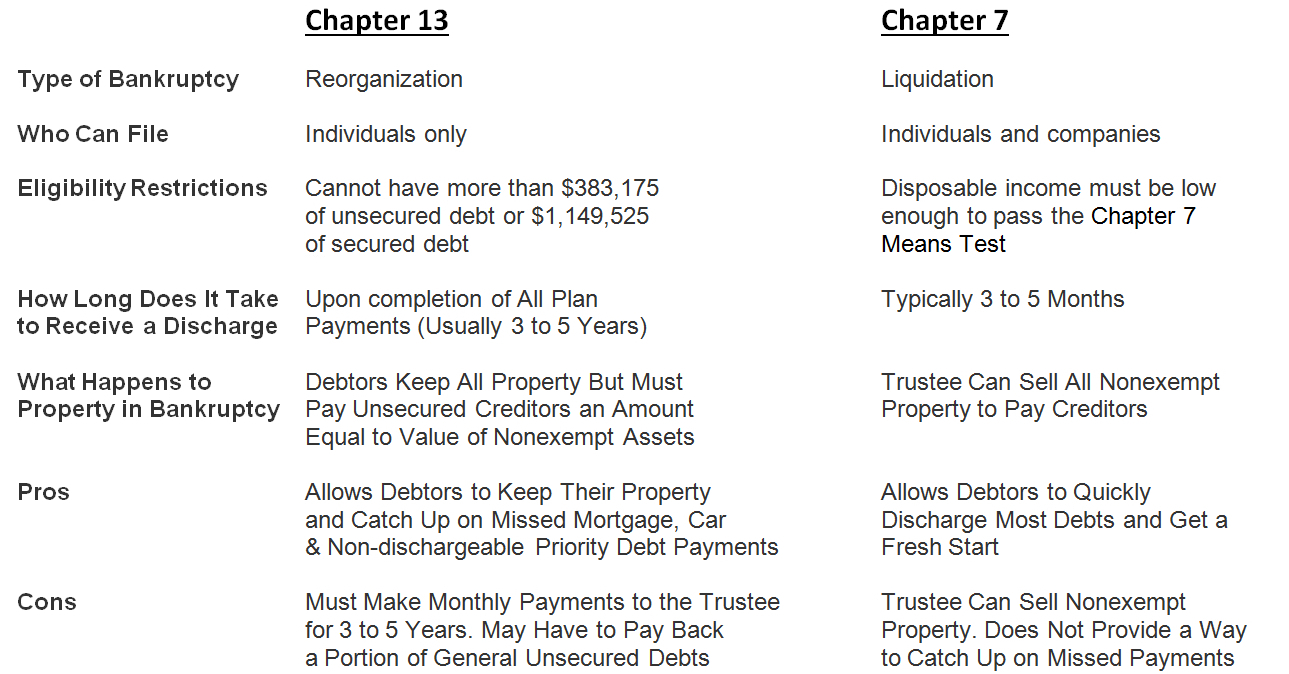

Chapter 13 Bankruptcy Vs Chapter 7 Bankruptcy Advantage Ccs

Chapter 13 Bankruptcy Vs Chapter 7 Bankruptcy Advantage Ccs

Important Differences Between Chapter 7 And Chapter 11 Bankruptcy You Must Know John T Orcutt Bankruptcy Blog

Important Differences Between Chapter 7 And Chapter 11 Bankruptcy You Must Know John T Orcutt Bankruptcy Blog

Chapter 7 Vs Chapter 11 Bankruptcy Which Bankruptcy To File

Chapter 7 Vs Chapter 11 Bankruptcy Which Bankruptcy To File

Alikhan Law Office Llc In Las Vegas Nevada 702 374 6619

Chapter 13 Bankruptcy Avondale Bankruptcy Attorneys

Chapter 13 Bankruptcy Avondale Bankruptcy Attorneys

Chapter 15 Creditors Rights And Bankruptcy Ppt Video Online Download

Chapter 15 Creditors Rights And Bankruptcy Ppt Video Online Download

Difference Between Chapter 7 And Chapter 11 Bankruptcy Whyunlike Com

Difference Between Chapter 7 And Chapter 11 Bankruptcy Whyunlike Com

Chapter 7 Vs Chapter 13 Bankruptcy Explained

Chapter 7 Vs Chapter 13 Bankruptcy Explained

What Is The Difference Between Chapter 7 13 And 11 Ball Bankruptcy Las Vegas

What Is The Difference Between Chapter 7 13 And 11 Ball Bankruptcy Las Vegas

Bankruptcy Info Topics History Utah Bankruptcy Attorneys

Bankruptcy Info Topics History Utah Bankruptcy Attorneys

/GettyImages-186881506-b0211c11fdcc4f1ab3487a6f9ce70810.jpg)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.